2021 Stocks, Investments and the Economy

Friends of BAI, Good Day and Happy New Year.

We hope the holidays were restful and time well spent. It’s now time to get back into the work groove. May all our dreams -family, health and wealth -come true in 2021.

This week’s article will cover stock and investment outlooks for 2021, with the 5 main factors that will affect the market and economic recovery.

We will finish with the Georgia Senate Run-off, and why the results there will greatly affect the next 2 years in the US.

5 investment themes to watch out for in 2021

Vaccine Progress

Second Round Stimulus Checks

Ongoing Low Fed Rates

Economic Growth and Corporate Earnings

The Georgia Senate Run-Off

Photo by Hakan Nural on Unsplash

Vaccine Progress

“By next summer the U.S. will be starting to go back to normal. And by the end of the year, our activities can be fairly normal, if we’re also helping these other countries.”

He added: “The end of the epidemic, best case is probably 2022. But during 2021, the numbers, we should be able to drive them down, if we take the global approach. So, you know, thank goodness vaccine technology was there, that the funding came up, that the companies put their best people on it. That’s why I’m optimistic this won’t last indefinitely.”

Bill Gates

This is a quote from last September from Bill Gates, owner of Microsoft and the Bill and Melinda Gates Foundation.

He outlines a best case scenario for US and Global recovery, emphasizing the need for a global approach to vaccination.

Sceptics doubt the effectiveness of the incoming vaccines, and large segments of the US population have voiced opposition to receiving it.

“Researchers were expecting a vaccine efficacy (VE) similar to what we see with influenza (around 50% to 60%). What Pfizer/BioNTech and Moderna delivered were respective VEs of 95% and 94.5%. On the surface, these figures offer a real chance to halt the pandemic.”

Photo by Giorgio Trovato on Unsplash

Second Round Stimulus Checks for 2021

“Some have criticized the $600 checks — half the amount distributed for individuals under the CARES Act — as too small, saying that they won’t cover basic living expenses such as a mortgage payment or other monthly bills. But the money is a “godsend” to people who “are really struggling,” said Lacey Langford, a Greensboro, N.C.-based financial counselor with a focus on military families. “

As it stands, second round stimulus checks were slated to go out at $600. Due to opposition from the Democrat Party and the outgoing Republican President Trump, the amount went up to $2000. Until Senator House Leader McDonnell rebuffed the bill increase on December 28th and 31st. We probably won’t know the exact amount until they get sent out. And, if the Dems win the Senate in the Georgia run-off we are almost certain to see another round of stimulus checks after this checkered one.

Photo by Alex Bierwagen on Unsplash

Ongoing Low Fed Rates

“We think that the economy’s going to need low interest rates, which support economic activity, for an extended period of time … it will be measured in years,” Powell said. “However long it takes, we’re going to be there.”

“We do think it will get harder from here — because of those areas of the economy that are so directly affected by the pandemic still,” Powell told National Public Radio in an interview, referring particularly to sectors like leisure, hospitality, travel and entertainment that depend on large gatherings made unsafe by the virus.”

Federal Reserve Chairman Jerome Powell

It seems that the Fed will stay low throughout 2021, as expressed by the Reserve Chairman.

Access to low interest rate loans are intended to give homeowners and small businesses a life-line in this troubled economy.

Furthermore, the low interest rate backdrop will encourage investors to continue favoring equities relative to bonds because of the prospect of relatively higher returns. In turn, that could help to push stock prices higher.

Photo by Vlad Busuioc on Unsplash

Economic Growth and Corporate Earnings in the New Year

“If the Republicans can block Biden’s tax hikes, agree to a potential stimulus deal in late January, and a cash-rich investor pool keeps believing in the US economy for 2021, we will see new records for the DOW, S&P, NASDAQ and Russell 2000. Small caps are looking good for 2021.”

To get a wide angle view of the market and economic recovery let’s review the points above, and analyze the implications of the of the Senate Run-Off Results (see below).

The market could continue to see record levels in all types of stocks and sectors, particularly tech, biotech and housing, but how that translates to the economy in general waits to be seen. Major sectors of the American economy, ie travel, hospitality, entertainment and leisure are all severely depressed. Everything has to come together perfectly, between the markets and COVID recovery, to ensure a swift economic recovery (ie end 2021 into 2022) across the board.

Photo by Clay Banks on Unsplash

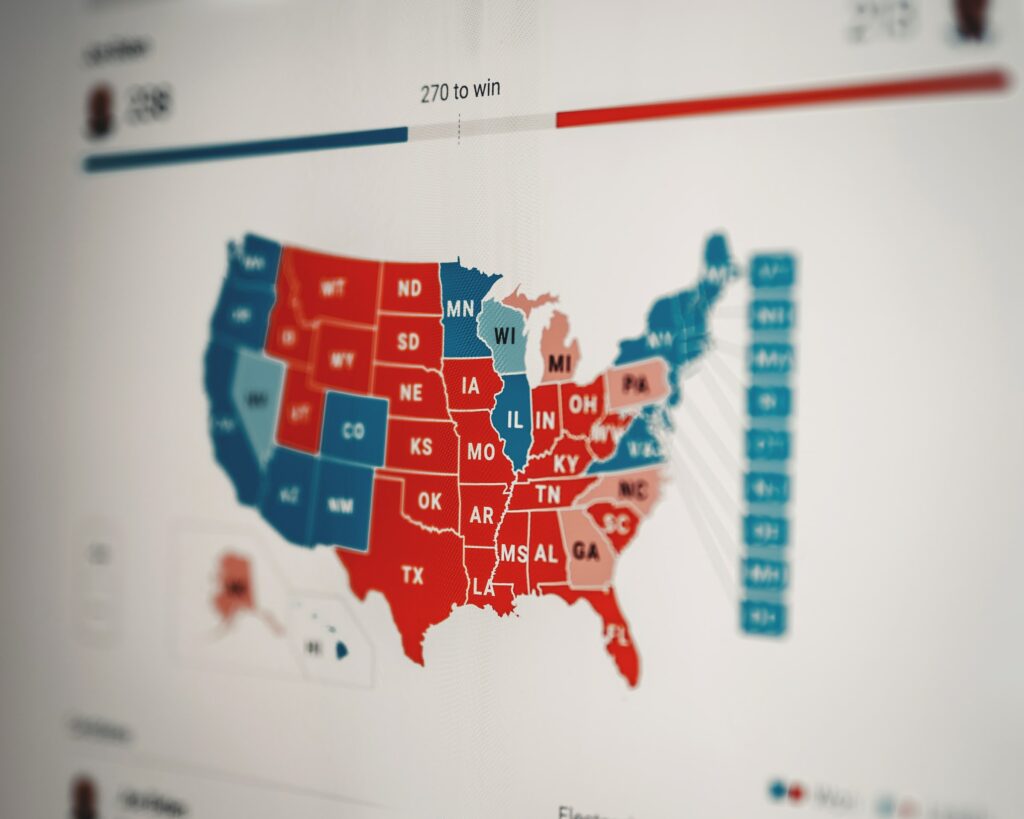

The Georgia Senate Run-Off

This run-off will decide who controls Senate for the next 2 years. Which party runs the Senate will greatly affect economic recovery, the stock market, COVID responses as well as US-international relations.

In Georgia, the Senate Run-Off Race is for the last 2 remaining Senate spots, as in the November election the top candidate did not win by a majority. According to Georgia state law, a run-off vote between the top 2 candidates settles the victory, in this case, today, January 5th, 2020.

- If the Dems win Senate is at 50-50 with tie breaker going to vice-president elect Kamala Harris.

- If the GOP wins, Senate stays at 52-48, continuing Republican control.

Pros and Cons of either party controlling Senate

If the Senate stays Republican, expect:

- Stronger confidence in the stock market, as corporate taxes stay low

- Slower and less comprehensive COVID response

- Toss up on economic recovery, as that’s tied into COVID recovery

- International relations with some countries will stay tense.

If the Senate goes Democrat, expect:

- A slowing in the stock market as corporate taxes increase from 21% to 28%

- More comprehensive and thorough COVID response

- Toss up on economic recovery, as markets may slow, but society may get back to normal more quickly with Dem Senate

- International relations should improve with many countries and it’s likely relations with the UN and NATO will improve and the US is projected to re-enter the Paris Climate Accord.

Historically, the stock market has done best with a Democrat President and split Congress. However, the economy has always done well under a new Democrat President, posting average gains of 17% in the subsequent year.

Photo by Gary Meulemans on Unsplash

According to gordcollins.com, optimism still reigns supreme for 2021:

- Rising corporate earnings

- Two rounds of stimulus likely

- After a small correction, growing consumer spending will energize earnings and stock prices

- Winter season hasn’t turned out too bad for corporate earnings so far

- Travel is already picking up and will by June boosting hotels, restaurants, and gasoline sales

- Rising consumer confidence as employment grows

- The fear of Covid infections diminishes

- Less strain on health care

- Surgeries and hospital revenue resume driving demand for medical supplies

- We’re still in tough during the next 3 months, but by the next 6 months, the recovery should be in full swing and carry on for many years.

We hope today’s email will help you navigate the New Year investment climate with confidence.

The investments at BAI Capital are in Private Equity Real Estate Funds, in other words, shares in Real Estate Development Projects. We also sell property units of these same American developments, at both pre-build and after construction prices. EB5 Visa Investors can petition for their US Green Card – via investment in the US economy – with our TEA approved Development Projects. Our uniquely located risk-managed investments offer the balanced investor an attractive way to diversify their portfolio.

https://baicapital.com/invitation-for-your-limited-opportunity-at-archer-place/

Feature Photo by Zach Vessels on Unsplash